Despite steadily declining prices of Bitcoin and turmoil on the markets today, some of the largest mining companies are unfazed and insist their operations will not be affected by negative price volatility.

Some even see it as an opportunity to gain market share as smaller competitors collapse.

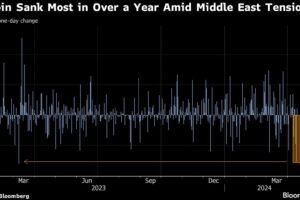

Bitcoin (BTC) prices have been on a steady decline all year up to the past 24 hours, when the crash accelerated to reach the lowest point since December 2020. However, miners have not been deterred amid that tremendous pressure. Some may even have more fervor for mining if the downtrend in Bitcoin continues through 2022.

Each of three different mining operations — two large public companies and one private mining company — that Cointelegraph reached out to shared cool emotions about the prospect of a bear market. They believe it will have little to no effect on their business plans.

Bitcoin miner Marathon Digital Holdings (MARA) said that its “asset-light strategy” will keep it insulated from nearly all the effects of a bear market. VP of Corporate Communications Charlie Schumacher told Cointelegraph that it maintained a cost basis of about $6,200 per BTC mined in Q1 by “outsourcing the muscle of our operations and keeping the intellectual power within the firm.”

Marathon is the third-largest holder of Bitcoin (BTC) among public companies according to BitcoinTreasuries. It has the capacity to generate 3.9 exahashes (EH/s) of hash power. MARA is down 15.42% and is trading at $9.97 in after hours trading. It is down 92.6% from its Dec. 2014 high of $134.72.

Schumacher added that the exit of other miners due to capital constraints during bear markets creates an opportunity for larger operations like Marathon’s which can take advantage of lower mining difficulty from a decrease in hashpower and competition on the Bitcoin network.

“As the hash rate declines, there’s a downward difficulty adjustment, which decreases the energy expense for miners who remain hashing. Those who are left standing can therefore benefit by potentially earning more Bitcoin.”

Cointelegraph also received responses from Riot Blockchain…

..