(Bloomberg) — Bitcoin selling may become evident as the date of the so-called halving nears but the event is set to bolster the price of the largest digital asset longer term, according to the head of the Crypto.com exchange.

Most Read from Bloomberg

The halving reduces new supply of Bitcoin and is expected around April 20. Historically, it’s proved a tailwind for prices, though there are doubts about whether a repeat is likely given Bitcoin already hit a record high in mid-March.

“As we approach this date there may be some selling coming up” due to buy-the-rumor, sell-the-news trading, Crypto.com Chief Executive Officer Kris Marszalek said in a Bloomberg Television interview on Tuesday.

Over a longer period, the halving will make a “substantial difference” and is a “positive development for the market,” he said.

Read more: Bitcoin ‘Halving’ Will Deal a $10 Billion Blow to Crypto Miners

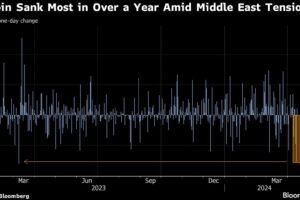

Bitcoin fell 1.5% to $62,180 as of 12:47 p.m. in Singapore. Inflows into three-month-old spot-Bitcoin exchange-traded funds in the US helped the token reach an all-time peak of $73,798 last month.

“I expect pretty decent action within the six months following the Bitcoin halving,” Marszalek said.

The halving will cut the amount of Bitcoin that so-called miners can earn each day for validating transactions to 450 from 900. Miners compete for the reward by solving mathematical puzzles using superfast computers.

On the outlook for Crypto.com, Marszalek said the digital-asset exchange is hiring thoughtfully and has approximately “a couple of hundred” openings.

The platform will begin offering services for South Korean retail customers later this month, an expansion Marszalek described as a long-term strategy.

Crypto.com is among the biggest digital-asset exchanges. Trading volume on the platform over the past 24 hours topped $1.5 billion, CoinGecko figures show.

(Updates with more comments from Marszalek from the eighth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

..