Shortly before the US Securities and Exchange Commission approved spot bitcoin exchange-traded funds (ETFs) on Wednesday night, it reissued a “no FOMO” warning to investors.

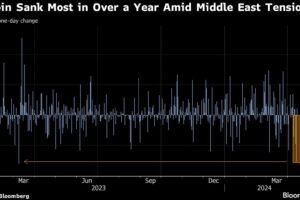

The warning not to invest over “fear of missing out” emphasized the volatility of digital assets, noting how trendy cryptocurrency investments go through extreme highs and lows, representing billions of dollars in gains — and losses.

Even after Wednesday’s announcement, SEC chair Gary Gensler said in a statement that despite the approval of the ETF listing, “we did not approve or endorse bitcoin.”

The SEC’s blessing brings industry standardization and regulation to digital asset investing. But financial experts urge caution, warning mainstream investors to tread carefully as bitcoin (BTC-USD) is still considered a speculative asset.

“From a very conservative financial perspective, you have to be very careful,” Kiran Garimella, assistant professor at the University of South Florida Muma College of Business, told Yahoo Finance. “If the financial instrument that’s being traded doesn’t actually represent anything of specific value underlying it, then you’d have to sit back and question that.”

But first, what exactly is a spot bitcoin ETF?

Spot bitcoin ETFs are investment vehicles that track the performance of bitcoin. Investors purchase shares of the fund, which is managed by asset managers who hold the actual bitcoin and its immediate value (“spot”) as the underlying asset. Those managers make money on management fees and on the slim margin between the actual price of bitcoins (which fluctuates) and the price at which they sell the shares.

Story continues

While the value of the ETFs will move in tandem with bitcoin, the funds may be more stable as fund managers can utilize different financial instruments within the fund to soften the volatility.

“An ETF not only makes it much easier to buy and sell and trade these bitcoins, it could also cover some of the strategic risk for you,” Garimella said.

The world’s first bitcoin originated in 2008 and is credited to a still-unknown person who used the pseudonym Satoshi Nakamoto. It was…

..