Dow Jones futures and the other major indexes threatened to extend losses, as Nvidia (NVDA) continued to slide on the stock market today. Meanwhile, bitcoin rallied to record highs.

X

Dow Jones futures fell 0.4% vs. fair value in morning action Monday, as did S&P 500 futures. Tech-heavy Nasdaq 100 futures moved down 0.5% before the opening bell.

Among U.S. exchange traded funds, the Nasdaq 100 tracker Invesco QQQ Trust ETF (QQQ) was down 0.7%, while the SPDR S&P 500 ETF (SPY) lost 0.5%.

The 10-year Treasury yield ticked lower to 4.07%. Further, oil prices added to Friday’s losses, as West Texas Intermediate futures fell 0.5%, trading around $77.60 a barrel.

Artificial intelligence titan Nvidia declined 1.5% Monday morning, threatening to add to Friday’s 5.6% tumble. Nvidia stock, however, remains more than 80% above a flat base’s 505.48 entry and is an IBD Leaderboard stock.

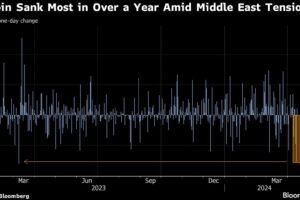

The price of bitcoin rallied 2.6% Monday morning, hitting a fresh record high and trading above $71,400. Cryptocurrency stock Coinbase (COIN) jumped another 6.3% in premarket action, sharply above a 193.64 buy point.

Be sure to read how to adjust to changing market conditions, with IBD’s new exposure levels.

Stock Market Today

Tuesday’s release of the consumer price index from the U.S. Labor Department takes the spotlight this week. The CPI is expected to rise 0.4% on the month with an increase of 3.1%. Wall Street expects core prices in February to climb 0.3%, with a year-over-year rise of 3.7%.

In addition, U.S. retail sales are set to be released on Thursday, a key reading on the consumer mindset.

Key earnings reports this week include Adobe (ADBE), Oracle (ORCL) and Jabil (JBL).

Dow Jones Falls

On Friday, the Dow Jones Industrial Average dropped 0.2%, while the S&P 500 moved down 0.7%. The tech-heavy Nasdaq composite sold off 1.2%.

Friday’s Big Picture column commented, “A majority of the S&P 500 sectors ended Friday in the red. The defensive utilities and real estate sectors as well as the energy sector rose on the day. In contrast, technology and consumer discretionary had tough sessions.”

Now is an important time to…

..