Text size

As the market rebounds, speculative stocks are stirring. For proof, consider Cathie Wood’s ARK Innovation ETF, up about 40% since mid-June.

David Swanson/Reuters/Alamy

What bear market?

Stocks continued their summer rally this past week as better-than-expected inflation results helped lead to a 3.3% gain in the

S&P 500

index, its fourth consecutive weekly advance. The impetus was good news on inflation: The U.S. consumer price index was unchanged in July, compared with a consensus estimate of a 0.2% increase. While the CPI is still up 8.5% in the past year, investors are betting that inflation has peaked and could be running at closer to 4% by year end.

The S&P 500 now is down a relatively modest 10.2% for the year, having recouped more than 50% of its losses since its mid-June low. The index topped 4232 on Friday, a 50% retracement of the bear move, before closing at 4280.15.

The

Dow Jones Industrial Average

is off just 7%, helped by rallies in

Chevron

(ticker: CVX) and defensive stocks such as

Merck

(MRK),

Amgen

(AMGN), and

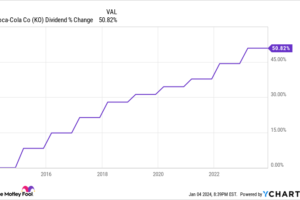

Coca-Cola

(KO).

The

Nasdaq

is still down 16.6% in 2022 but has rallied more than 20% from its June low, and speculative stocks are stirring. A bellwether of such is Cathie Wood’s

ARK Innovation

exchange-traded fund (ARKK), whose largest holdings include

Tesla

(TSLA) and

Roku

…

..