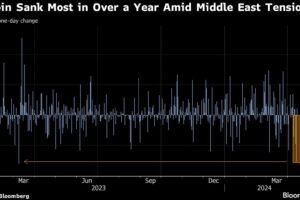

Bitcoin (BTC) has jumped up 5% on Nov. 10, and confidence is returning over the global macro outlook and the news that FTX began partially opening withdrawals for users.

Crypto and equities markets responded to (Consumer Price Index (CPI) data which showed inflation at 0.4% for the month and 7.7% from a year ago which was less than the expected 0.6% monthly and 7.9% increase. The news sent the Nasdaq up 6% and puts it on pace for the biggest one-day gain since 2020.

After volatility caused by FTX’s potential insolvency, Bitcoin price reacted to positive news of opening withdrawals and the positive equities movement to increase $1,000 in minutes.

Nasdaq and Bitcoin 3 month chart. Source: TradingView

With volatility still likely amid the ongoing FTX situation, there is still a sense of lessening doom among crypto commentators, but some analysts believe the bottom is still not in for the crypto market.

The picture for the rest of Q4 remains muddy, as some analysts still expect 2022 to copy the 2018 bear market. At the same time, there is hope that this bearish trend will be gone for good by the start of 2023.

The overall crypto market has been positive, including Solana (SOL) which is up 20% since Nov. 9 even after losing 32.4% of the total value locked in its decentralized finance (DeFi) ecosystem.

Let’s examine three major factors influencing crypto market strength in the current environment.

The Fed could change its tune on rate hikes

When Cointelegraph reported on why the crypto market saw fresh losses last month, the United States Federal Reserve was first on the list.

Concerns focused on unwavering policy keeping the U.S. dollar strong and rates surging higher for the foreseeable future — the worst-case scenario for risk assets.

At the same time, rumors are gathering over the outlook for rate hikes as the Fed runs out of room to maneuver. After the November 75-basis-point hike, suspicions are that policy will begin to U-turn, making smaller hikes in subsequent months before reversing altogether in 2023.

As such, any signal that the Fed is preparing to soften its hawkish stance is being seized on by markets…

..